Posts Tagged ‘Economy’

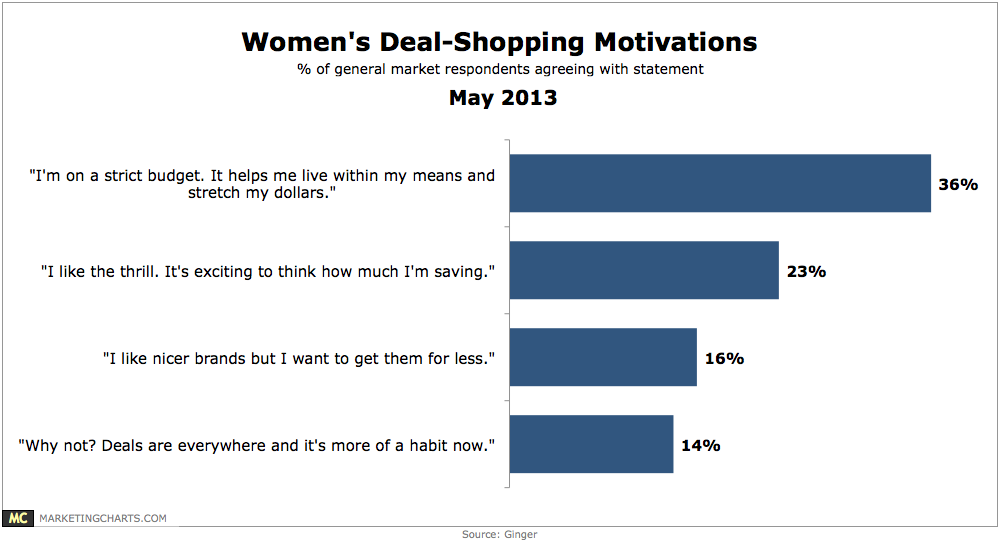

Female Deal Shopping Motivations, May 2013 [CHART]

Asked their motivation for deal shopping, 36% of “general market women” said that they’re on a strict budgets and that deals help them live within their means and stretch their dollars.

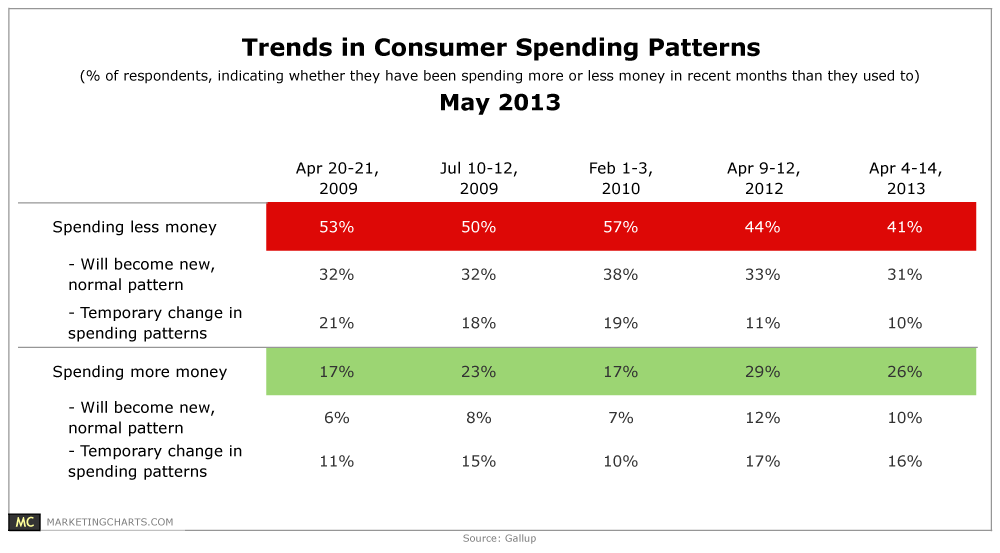

Read MoreConsumer Spending Patterns, May 2013 [TABLE]

Overall, 73% of Americans polled in early April said they have been spending either less (41%) or the same (32%) amount of money in recent months than they used to.

Read MoreMillennials Financial Difficulties, Q1 2013 [CHART]

The Shopper Sentiment Index, which measures the economy’s impact on consumers and how they approach grocery shopping, remained at approximately 85 among Millennials in Q1, a level it has stood at or around for a year.

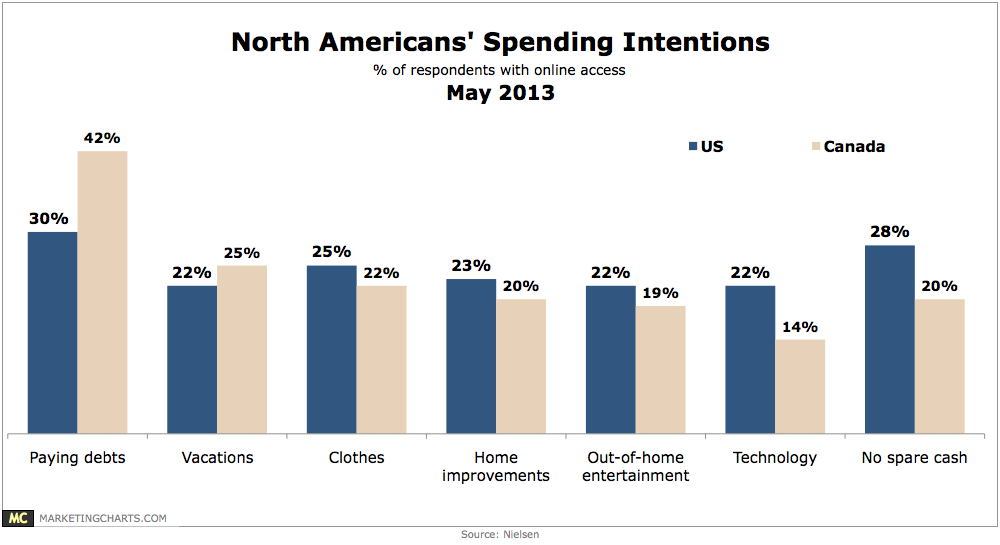

Read MoreNorth Americans' Spending Intentions, May 2013 [CHART]

North Americans plan to spend on discretionary items this year, up from 36% the previous quarter.

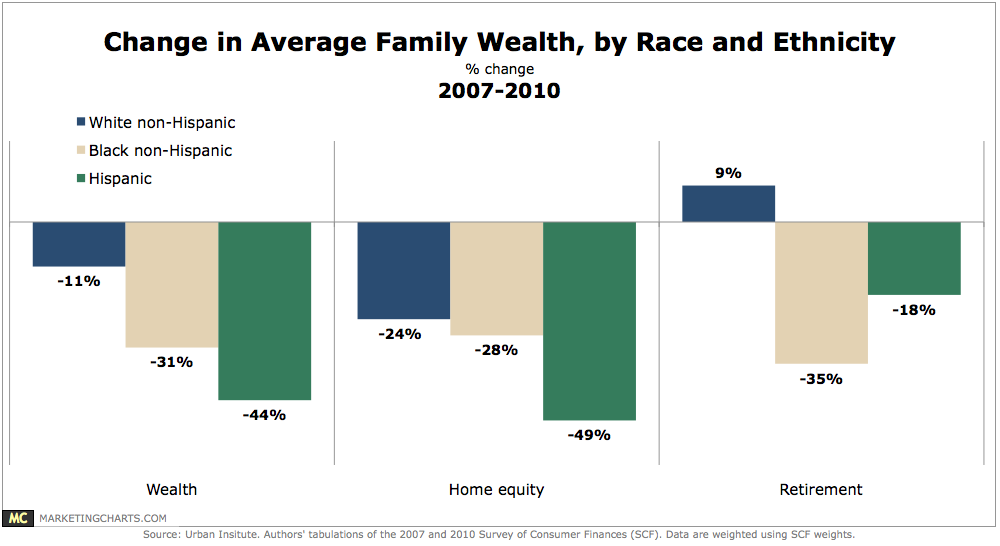

Read MoreChange In Family Wealth By Race & Ethnicity, 2007-2010 [CHART]

The Great Recession widened the wealth gap between whites and minorities in the US.

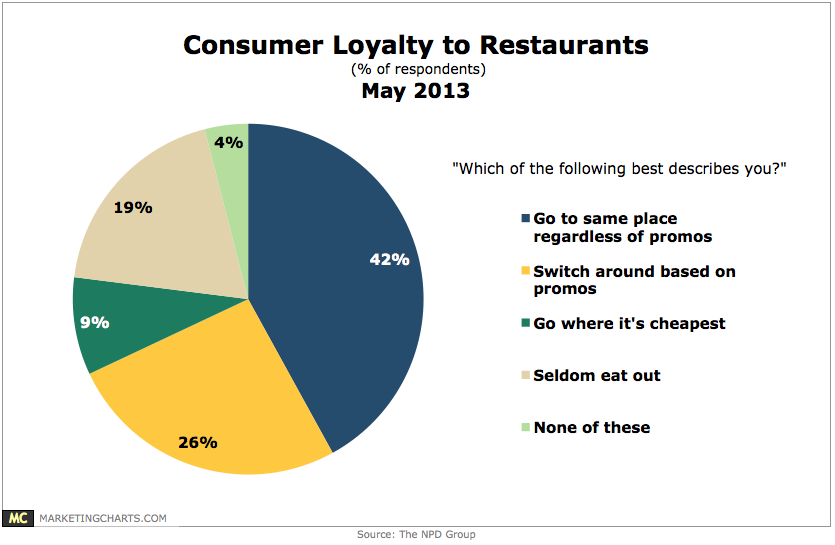

Read MoreCustomer Loyalty To Restaurants, May 2013 [CHART]

42% of consumers are loyal to their favorite restaurants and will go to them regardless of whether or not they have a promotion.

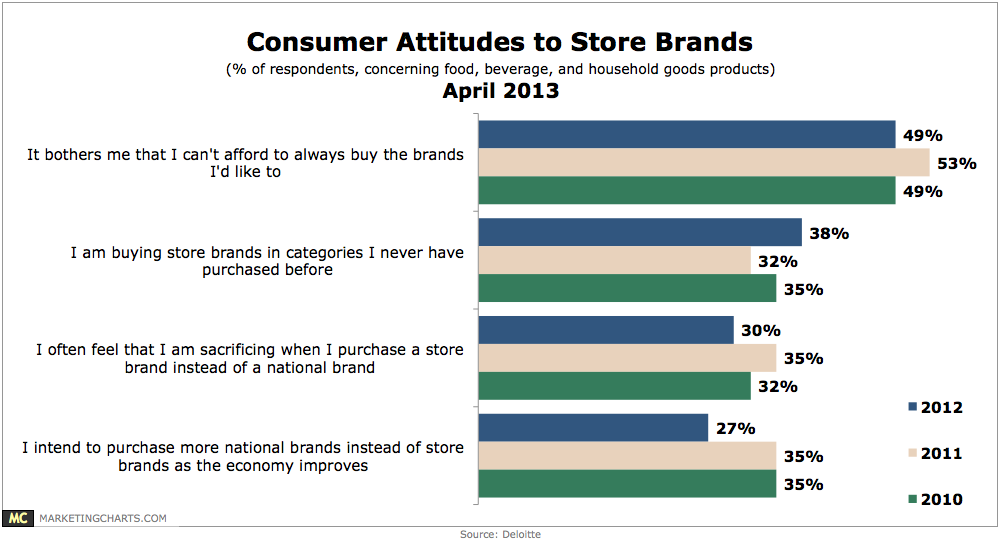

Read MoreConsumer Attitudes Toward Store Brands, April 2013 [CHART]

94% of Americans say they will remain cautious and keep their food, beverage and household goods spending at current levels even if the economy improves.

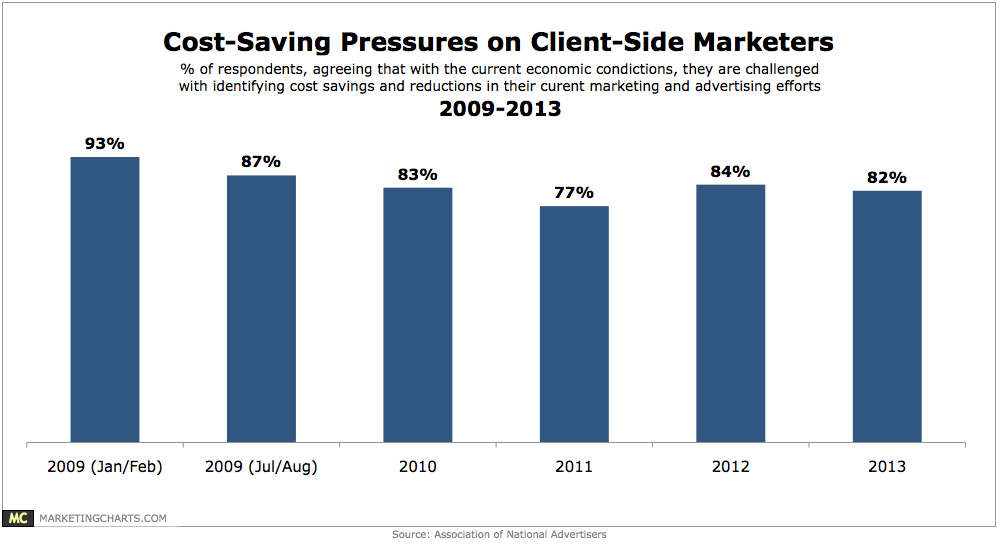

Read MoreMarketing Cost-Saving Pressures, 2009-2013 [CHART]

82% of marketers agree that with the current economic conditions, they’re challenged with identifying cost savings and reductions in their marketing and advertising efforts.

Read MoreAmericans Who Have Postponed Medical Treatment Due To Cost, 2004-2012 [CHART]

Three out of 10 consumers saying they had put off medical treatment due to cost within the last 12 months

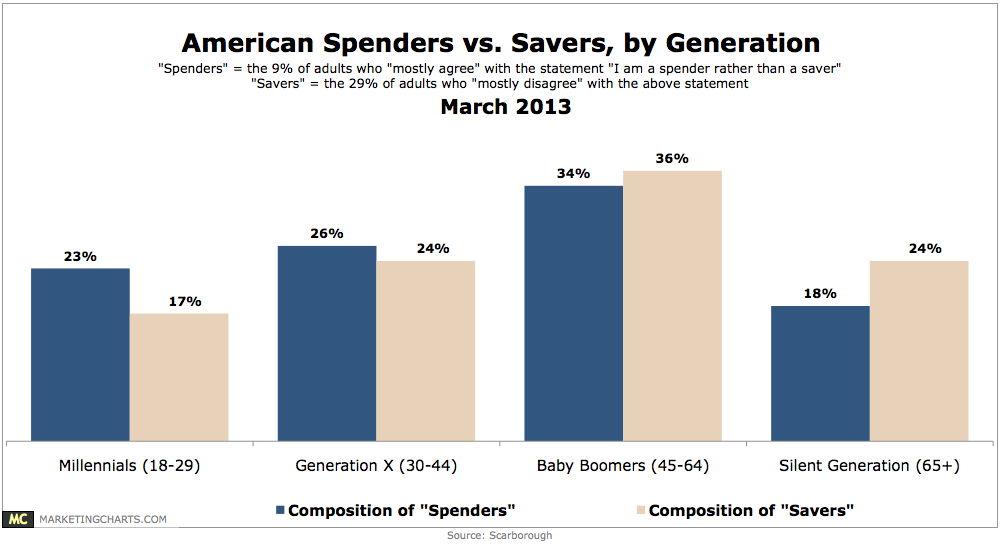

Read MoreAmerican Spenders vs. Savers By Generation, March 2013 [CHART]

Compared to the average adult, American Millennials (18-29) are more likely to view themselves as Spenders rather than Savers.

Read More